During a divorce or property settlement, emotions run high – and so can the temptation to protect certain assets. Some parties may try to gain an advantage by concealing money, transferring property, or undervaluing assets.

Hiding assets in divorce can lead to serious legal penalties in Australia. Under the Family Law Act 1975, both parties have a strict duty of full and frank disclosure. If the Court finds that a person has deliberately hidden the assets, the consequences can include reopening property settlements, cost orders, financial penalties, damage to credibility, and in extreme cases, contempt proceedings.

This guide will explore the legal penalties for hiding assets in divorce in Australia and explain exactly what counts as hidden assets. If you’re worried about financial dishonesty or simply want to understand your rights before you approach your separation, keep reading. The right information early can protect your financial future.

What Does Hiding Assets in Divorce Actually Mean?

Hiding assets in divorce means intentionally or recklessly failing to disclose the full extent of your financial position during a property settlement.

Legally, a person may be hiding assets if they:

- Transfer money to friends, family members, new partners, or related entities to keep it off the record

- Transfer property into someone else’s name for nominal or no value

- Underreport or undervalue business interests, real estate, investments, or personal assets

- Fail to disclose bank accounts (including overseas accounts)

- Conceal shares, managed funds, cryptocurrency, or digital assets

- Hide superannuation interests

- Use trusts, partnerships, or corporate structures to shield true ownership

- Delay commissions, bonuses, dividends, or income until after settlement

- Withdraw large sums from joint accounts without explanation

- Create, inflate, or exaggerate debts to artificially reduce the asset pool

- Dispose of property during proceedings to defeat the other spouse’s claim (which may breach section 106B of the Family Law Act 1975 (Cth))

- Withhold financial documents, tax returns, trust deeds, company records, or loan agreements

Importantly, the obligation extends beyond assets legally owned in your name. It includes assets you control, benefit from, or have an interest in, even indirectly.

In high-net-worth separations, complex structures involving trusts, corporate entities, and layered investments are common. However, complexity does not remove the obligation of transparency. The Court can look through artificial arrangements to determine the true financial position.

If there are suspicions of hiding assets in divorce, the Court may order:

- Subpoenas to banks, accountants, and third parties

- Independent valuations

- Forensic accounting investigations

- Examination of company and trust structures

No financial structure is immune from scrutiny.

Before understanding the penalty for hiding assets in divorce in Australia, it’s essential to clearly understand the legal concept that underpins everything: disclosure.

What Does ‘Disclosure’ Mean in Property Settlement?

Disclosure is the legal obligation to provide complete and accurate financial information to the other party and the Court.

Understanding disclosure is crucial because failure to comply is what triggers the penalty for hiding assets in divorce in Australia. In family law proceedings, disclosure can refer to:

- A specific financial document (e.g., bank statement or tax return)

- A legal obligation imposed by the Court rules

- The ongoing process of exchanging financial information

Disclosure requires each party to provide documents and information that accurately reflect their financial circumstances.

What Assets Must Be Disclosed?

Typically, disclosure includes:

- Bank statements

- Credit card statements

- Tax returns and Notices of Assessment

- Pay slips and employment contracts

- Business financial statements

- Trust deeds and company records

- Mortgage and loan documents

- Superannuation statements

- Property valuations

- Investment and share portfolio records

The purpose of disclosure is to identify the total asset pool before negotiating how it should be divided. Without full disclosure, negotiations lack transparency, and any agreement reached may later be challenged.

Let’s now look at what the law specifically requires.

The Legal Duty of Full Disclosure Under Australian Family Law

In Perth and across Western Australia, judges take non-disclosure seriously because the entire property settlement process depends on honest financial disclosure.

So, the obligation to disclose is not optional; it is a legal requirement.

Under the Family Law Act 1975 (Cth), each party has a strict and ongoing duty to provide full and frank disclosure of their financial circumstances. Although Western Australia has a separate Family Court system, similar disclosure principles apply in property proceedings.

If your financial circumstances change during proceedings; for example, you receive a bonus, inheritance, or sell property, you must update your disclosure.

What happens if you fail to comply?

Understanding this legal duty is essential, because once breached, it opens the door to significant consequences. Next, we examine exactly what those consequences and penalties can be under Australian law.

Legal Penalties for Hiding Assets in Divorce in Australia: What the Court Can Do

Australian family law is built on achieving a “just and equitable” division of property. When one party hides assets, it distorts the property pool and disadvantages the other party.

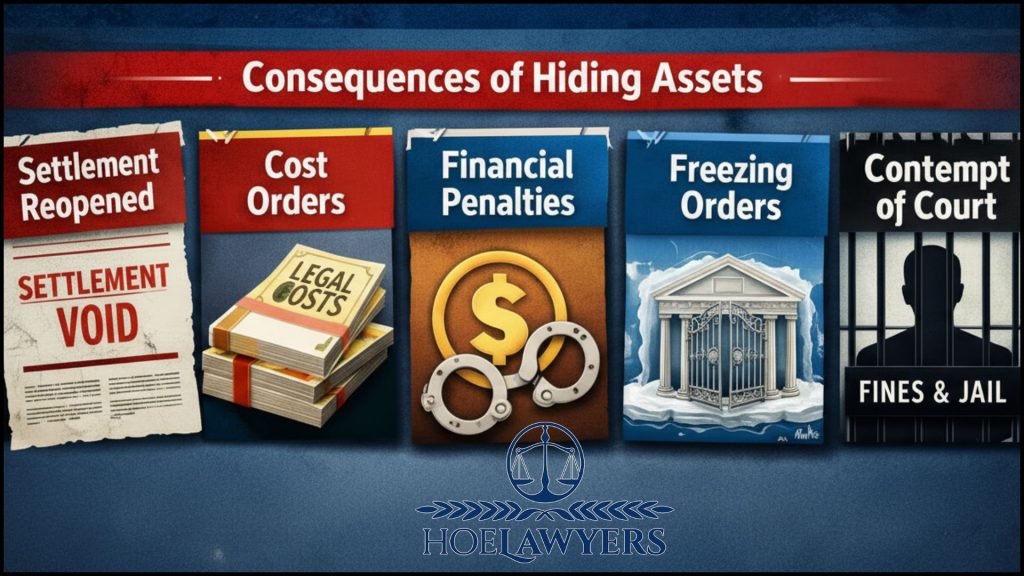

Concealing assets during property settlement is a serious breach of the duty of disclosure and can lead to orders that undo any unfair advantage, plus financial penalties – and in the most serious cases, contempt proceedings with fines or imprisonment.

1. Reopening or setting aside a settlement

If a financial settlement or consent orders were obtained because one party hid assets or misled the other, the Court has the power to set aside or vary those orders and make fresh property orders under section 79A of the Family Law Act 1975.

That means a previously “final” deal can be undone and a new, less favourable division imposed on the person who concealed assets.

2. “Add-backs” and adjustments to the asset pool

Courts can treat dissipated or hidden funds as still part of the asset pool; commonly called an “add-back”, and adjust the percentage split to compensate the honest party.

This neutralises attempts to shrink the pool by transfers, sham loans or undervaluations. Where evidence shows assets were intentionally removed or stripped, judges will often add them back for the purposes of division.

3. Costs orders and adverse cost consequences

If concealment forces extra investigation (subpoenas, valuations, forensic accounting) or causes unnecessary delay, the Court may order the non-disclosing party to pay the other party’s legal and expert costs. Under certain rules and case law, costs consequences can be significant, particularly in complex or high-net-worth separations where investigative work is costly.

4. Freezing, preservation and “claw-back” powers

The Court has procedural tools to stop dissipation while proceedings are live; for example, freezing (preservation) orders and subpoenas for bank, ASIC or Titles Office records.

The Family Law Act also contains claw-back powers (e.g. section 106B) that let the Court set aside or restrain transactions intended to defeat a spouse’s claim. These powers are often used in urgent Perth-based applications to prevent assets being removed from reach.

5. Contempt, perjury and criminal consequences

Where false statements, forged documents or repeated concealment amount to serious interference with the Court’s processes, the offending party may face contempt proceedings or criminal referral. Section 112AP of the Family Law Act allows the Court to punish contempt by fine, imprisonment, or both. Though imprisonment in family law cases remains rare and reserved for the most egregious misconduct.

6. Damage to credibility and wider family law consequences

Even if a formal penalty is not imposed, an adverse finding about honesty can be decisive. Loss of credibility affects how a judge assesses marriage contributions, parenting credibility and spousal maintenance claims, so the reputational cost can be as harmful as financial penalties.

Hence, courts have broad and flexible powers; from reversing settlements and adding back hidden funds, to ordering costs, issuing subpoenas and, in the most serious cases, contempt sanctions. If you suspect hiding assets in divorce, acting early with an experienced divorce lawyer or family lawyers in Perth can help stop further dissipation and preserve your entitlements.

What To Do If You Suspect Hidden Assets During Divorce

Do not confront aggressively, do these first:

- Preserve documents immediately — download and save bank statements, tax returns, superannuation statements, property titles, business records, and any emails/screen captures that show transfers.

- Monitor joint accounts and transactions — flag unusual withdrawals/transfers and ask your bank to place holds or notify you of activity where possible.

- Put a written preservation request on record — send a polite, dated email or letter asking your ex not to sell, transfer or dispose of assets while the settlement is unresolved (this shows you took reasonable steps to preserve assets).

- Gather business records — if there’s a family business, collect profit & loss, BAS, invoices, director resolutions, and loan documents.

- Engage professionals — contact an experienced divorce lawyer and, if warranted, a forensic accountant — especially crucial in high-net-worth separations or complex corporate/trust structures.

- Seek urgent court orders if needed — your lawyer can apply for freezing/preservation orders, subpoenas (banks, ASIC, Titles Office) or urgent interim relief through the Family Court of WA; these tools stop dissipation and compel third-party records.

- Avoid self-help — do not attempt to seize property, hack accounts, or take other illegal steps — these can backfire and damage your case.

Conclusion: Hiding Assets in Divorce is Risky and Unethical

Hiding assets in divorce is neither clever nor harmless; it breaches the duty of full and frank disclosure under the Family Law Act 1975 (Cth). Attempts to conceal property, undervalue assets, or transfer funds to third parties frequently backfire, resulting in reopened settlements or varied Consent Orders, adverse cost orders, damage to your credibility in Court, and in extreme cases, contempt proceedings or criminal penalties.

The legal consequences for hiding assets in divorce in Australia are designed to restore fairness and protect the integrity of the process. If you’re planning how to approach your separation or moving through a divorce, getting clear, strategic legal advice early is the best way to avoid costly mistakes, especially in complex or high-net-worth separations.

At Hoe Lawyers, If you’re worried about hidden assets or need help managing disclosure, contact us for a no-obligation consultation — early action can protect your financial future.

Are you concerned that your former partner is transferring money, undervaluing business interests, or failing to disclose assets?

Protect Your Financial Future with Experienced Family Lawyers in Perth – Hoe Lawyers

Our experienced family lawyers and divorce lawyers work with individuals, families and business owners to enforce disclosure, preserve assets and secure fair outcomes.

We specialise in property settlement disputes, high-net-worth separations, subpoenas and urgent freezing orders; getting the documents, valuations and court orders you need to preserve your entitlements.

So, contact our experienced family lawyers to know your options and next steps.

Book Your Initial Consultation Today

FAQs

- What are the legal consequences of not disclosing assets in an Australian divorce?

Failure to disclose assets can result in cost orders, adjustments to the property settlement, reopening of final orders under section 79A, and in serious cases, contempt proceedings or criminal consequences. The Court treats non-disclosure as a serious breach of duty.

- How long after a divorce can you claim assets in Australia?

You generally have 12 months from the date your divorce becomes final to file an application for property settlement or spousal maintenance. After this period, you must seek special permission from the Court.

- How can I find out if my ex is hiding money?

Suspicious financial behaviour may be investigated through:

- Subpoenas to banks and financial institutions

- ASIC company searches

- Property title searches

- Superannuation information requests

- Forensic accounting analysis

Experienced family lawyers can guide you through these investigative steps.

- What evidence can prove hidden assets in divorce proceedings?

Common evidence includes:

- Undisclosed bank statements

- Business records and tax returns

- Trust deeds and company documents

- Property transfers for undervalue

- Cryptocurrency transaction histories

- Forensic accounting reports

Documentary evidence is critical in proving concealment.

- Can hiding superannuation be treated differently from hiding property?

No. Superannuation is treated as property under Australian family law. Failure to disclose superannuation interests carries the same penalty exposure as hiding real estate, business interests or other assets.

- Can hiding assets in divorce result in imprisonment?

While rare, deliberate perjury, fraud, or serious contempt of court can result in fines or imprisonment under federal law. Imprisonment is reserved for extreme cases involving serious interference with the administration of justice.